Case Study - Helping build a NeoBank in Latin America

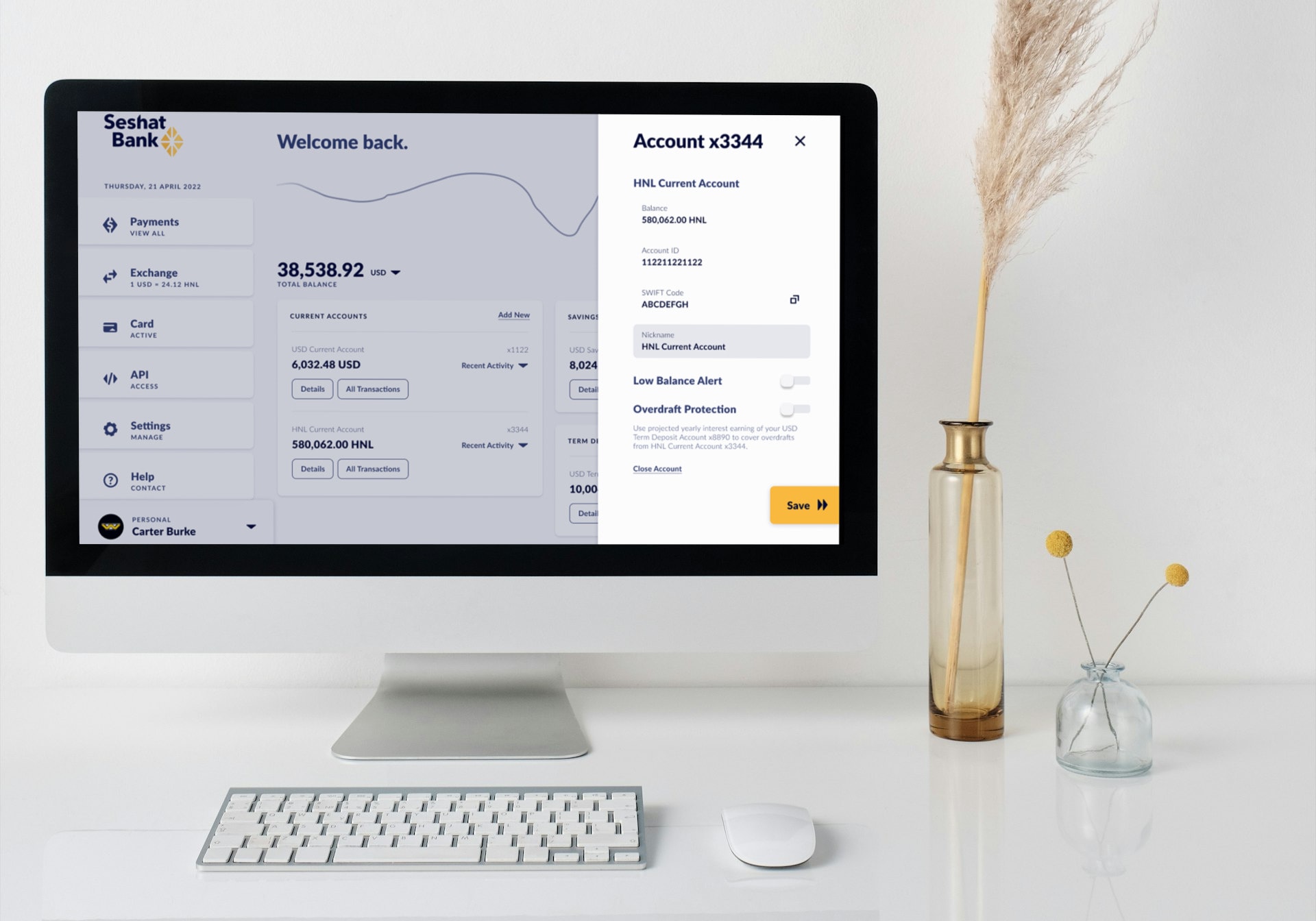

Seshat Bank is a digital bank that is focused on providing financial services to the unbanked population in Honduras. We helped them build their Banking Web Application.

- Client

- Seshat Bank

- Year

- Service

- Web Application, System Integration

Overview

At Digital Arts, we had the privilege of collaborating with Seshat Bank, a trailblazer in digital banking, dedicated to serving the unbanked population of Honduras. Our mission was to develop a Banking Web Application that not only addressed the unique financial needs of this demographic but also set a new standard in digital banking experience.

Design and User Experience: A Pixel-Perfect Vision

Working closely with Seshat Bank's designers, we meticulously crafted a user interface that was not just visually appealing but also incredibly intuitive. Our goal was to create a pixel-perfect representation of Seshat Bank's vision, where every element and interaction was thoughtfully designed. We focused on simplifying the account creation process, ensuring that new users could easily navigate and complete their registrations without hassle.

For transactions, we engineered a seamless and efficient experience. Users could effortlessly perform a variety of banking operations, from simple fund transfers to more complex financial activities, all within a few clicks. Our design philosophy centered around minimizing user effort while maximizing functionality and accessibility.

Integration with Core Banking System

A critical aspect of our project was the integration with Seshat Bank's Core Banking System. This integration was key to providing real-time transaction capabilities and up-to-date account information. Our team implemented robust APIs and secure data transfer protocols to ensure seamless communication between the Web Application and the bank's core systems.

Uncompromising Security Measures

Security was paramount in this project. Given the sensitive nature of banking data, we implemented state-of-the-art security measures to protect user information and transactional data. This included multi-factor authentication, end-to-end encryption, and continuous monitoring for any potential security threats. Our approach ensured that both the bank and its customers could operate with confidence, knowing their data was safeguarded by the highest standards of security.

What we did

- Custom Frontend (Reactjs)

- Role-based Authentication

- API Integration

Their meticulous attention to detail in crafting a pixel-perfect UI, combined with an intuitive UX for account creation and transactions, has set a new standard in digital banking. The seamless integration with our Core Banking system, fortified with robust security measures, speaks volumes of their technical expertise and commitment to excellence.

CTO and Board Member

- Uptime Reliability

- 99.9%

- New Account Registrations

- 40%

- Faster Transaction Processing

- 3x

- Security Encryption Standards

- Advanced